Last Updated on March 16, 2024 by SPN Editor

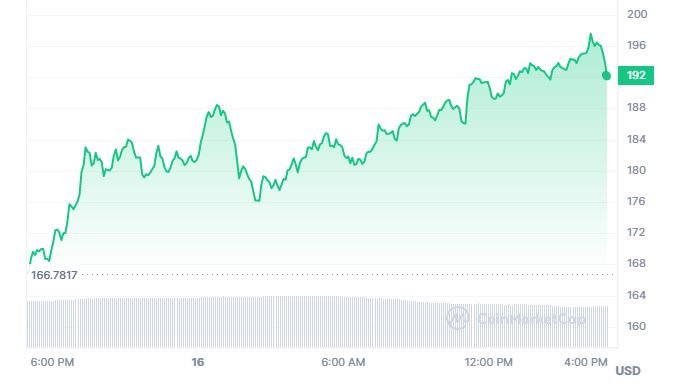

The decentralized finance (DeFi) darling, Solana (SOL), has recently captured the attention of investors, riding the wave of overall market optimism. With the token breaking the $170 barrier for the first time since January 2022, anticipation for a new all-time high is palpable.

However, amidst the bullish sentiment, crypto analyst Ali Martinez has raised a cautionary flag. In a recent post on X (formerly Twitter), Martinez highlighted technical indicators signaling a potential ‘sell signal’ for Solana. Specifically, the TD Sequential indicator has made an appearance, hinting at a potential downturn in SOL’s price.

Martinez’s observations reveal a pattern: each time this indicator flashed since December 2023, SOL experienced significant drops, ranging from 17% to 28%. His analysis suggests that a similar scenario could lead SOL to retrace to $152 or even $127.

Factors Driving SOL’s Rally

Despite this warning, Solana (SOL) continues to rally, positioning itself as the fourth-largest cryptocurrency by market capitalization, trailing closely behind stablecoins. What factors are fueling this surge?

- Shiba Inu (SHIB) Effect: The rise of Shiba Inu and other dog-themed tokens, such as Bonk (BONK), has created a buzz in the crypto space. Solana, with its robust infrastructure, has become an attractive playground for these projects.

- Project Popularity: Solana’s blockchain ecosystem hosts a growing number of projects, attracting developers and users alike. The network’s scalability and low transaction fees have contributed to its popularity.

- Web3 Integration: Solana’s Web3 smartphone, Saga, has turned heads. Users have discovered the ability to redeem millions of tokens directly from their devices, adding to the token’s allure.

While the market remains volatile, Solana’s journey continues to captivate investors, leaving them eagerly awaiting the next chapter in this DeFi saga. Stay tuned for further developments as the crypto landscape evolves.

Comparision of Solana (SOL) with other Stablecoins

Solana’s speed, low fees, and vibrant ecosystem position it as a strong contender in the crypto space. Ethereum, with its first-mover advantage and ongoing upgrades, remains a dominant force. Both networks contribute to the exciting evolution of decentralized finance and blockchain technology.

Scalability and Speed:

Solana (SOL): Known for its impressive scalability, Solana can handle a high throughput of transactions per second (TPS). Its consensus mechanism, called Proof of History (PoH), allows for parallel processing and efficient validation.

Ethereum: Ethereum, while widely adopted, faces scalability challenges due to its current Proof of Work (PoW) mechanism. However, Ethereum 2.0 aims to address this with the transition to Proof of Stake (PoS).

Transaction Fees:

Solana: Solana boasts low transaction fees, making it attractive for DeFi applications and token swaps.

Ethereum: Ethereum’s gas fees have been a pain point, especially during periods of high demand. Ethereum 2.0 aims to reduce fees through PoS.

Ecosystem and Projects:

Solana (SOL): The Solana ecosystem has grown rapidly, hosting various DeFi projects, NFT platforms, and gaming applications. Its Web3 integration and developer-friendly environment contribute to this expansion.

Ethereum: Ethereum remains the go-to platform for DeFi, NFTs, and smart contracts. Its established ecosystem includes projects like Uniswap, Aave, and MakerDAO.

Security and Decentralization:

Solana: While secure, Solana’s consensus mechanism differs from Ethereum’s. Some argue that its PoH approach may be less decentralized.

Ethereum: Ethereum’s long-standing track record and robust community contribute to its security. However, the transition to Ethereum 2.0 is critical for scalability and decentralization.

Token Utility:

Solana: Solana (SOL) serves as both a utility token (for network fees) and a governance token (for protocol upgrades).

Ethereum: Ether (ETH) is primarily used for gas fees and smart contract execution. It also plays a role in Ethereum’s governance.

Developer Adoption:

Solana: Solana’s developer community is growing rapidly, with hackathons and grants encouraging innovation.

Ethereum: Ethereum’s established developer base continues to drive its ecosystem forward.

Market Capitalization:

As of now, Ethereum holds a significantly larger market capitalization than Solana (SOL). However, Solana’s recent surge has caught the attention of investors.

Disclaimer: This news feature is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a qualified financial professional before making investment decisions.